Guerrilla Sales Enablement

- Mike Pinkel

- Oct 25, 2024

- 24 min read

Updated: Nov 7, 2025

“When I got here, nobody showed me how to do my job. That’s a fact.”

So said a colleague of mine a while back. And he was right, he’d had to figure things out on his own.

My colleague was a badass: He could make it happen. But he’d have been a lot more productive a lot sooner if he’d had access to the right enablement.

What’s worse, there are plenty of perfectly good employees who won't figure it out if they aren’t properly enabled.

This creates an enablement doom loop: Sales reps who could have succeeded fail instead and get replaced by new reps… who also fail and get replaced in an endless cycle.

This kind of employee churn lights money on fire and burns commercial opportunities.

How badly does it hurt? Let's say you're hiring reps with annual quotas of $1,000,000 and target earnings of $200,000 per year; half salary, half commission. Let's assume that reps normally become productive after a ramp period of six months.

A single failed sales hire can cost you $50,000 in wasted salary plus another $20,000 In overhead and recruiting costs. And instead of getting $500,000 in revenue from that rep in their first year, you could end up with $0.

Ouch.

Let's do better. In this article, we'll cover the following topics:

The Challenge

It seems like there’s an easy fix: Companies need to invest some time and effort into sales enablement.

It’s not that simple: Most companies HAVE tried to create proper sales enablement.

The real issue isn’t an absence of effort; it’s that those efforts often don’t work. Why?

Lack of a Plan

At small companies, enablement usually fails because there's no plan.

I was at a company where the CEO took several weekends out to write up a sales playbook. I was at another where the company had hired a full time enablement person who’d been on staff for months.

Did either of these efforts have much effect on the way the sales team operated? No.

Why not? There wasn't enough of an effort to diagnose needs and plan how to address them.

Small companies create resources on impulse: There's a pressing need from a specific deal so something gets built. Or someone has a brainstorm so they build a resource.

This results in a collection of random resources. Some ARE useful on their own. But the collection doesn't cover all the team's needs and it's hard for a new hire navigate their way around them.

What's more, the resources aren't tied together by clear unifying ideas. Great sales processes prove a set of points about value over a series of sales conversations. Creating resources on impulse results in a collection of resources that don't add up to a powerful sales process.

Lack of Flexibility

At established companies, enablement often fails because it's inflexible.

In other words, there IS a plan... but too much of one.

That plan is driven by the vision of senior leaders because they control the enablement resources.

The enablement plan reflects their concerns: They're responsible for the whole company and typically get involved in very large, late-stage deals. So resources are designed to work for the whole company and are built to address the challenges of the most complex late-stage deals.

Here's the thing: Good general ideas may not work for specific teams. And most sales conversations aren't like the ones that senior execs see in complex late-stage deals.

There's another complication: Execs have a lot of resources to realize their vision... which seems like a good thing, right?

Sometimes it's good... but sometimes all those resources result in enablement that's too elaborate.

Sales tools are exquisitely designed... but are also hard for sales reps to edit and adapt to their deal. The company buys an software platform for enablement... but it quickly fills with a profusion of resources that sales reps don't know how or when to use.

The result is enablement that looks pretty but doesn't respond to the everyday needs of sales reps in the field.

The Solution

So how do we fix this? We have to find a way to combine a clear plan with the flexibility that sales reps need in the field.

We can't just marshal all of our resources and throw them into a frontal attack on our enablement problems.

We need a guerrilla enablement strategy: nimble, effective, and useful for small teams. It will have three key aspects: modular structure, built-in adaptability, and rigorous prioritization.

Modular Structure

Structure usually kills flexibility: Structure done poorly is rigid.

But structure can also create flexibility. Think about Legos: You can build anything you want with Legos because the blocks follow compatible designs and fit together in predictable ways.

Do the same with your enablement plan: Create building blocks that the sales team can rearrange to suit the needs of their deal and that your enablement team can rearrange to suit the needs of a specific sales asset.

Those building blocks are Themes: the major value messages for our product. We'll define Themes that match our ideal customer profile (ICP) and then build assets and conversations by mixing and matching the Themes we've created.

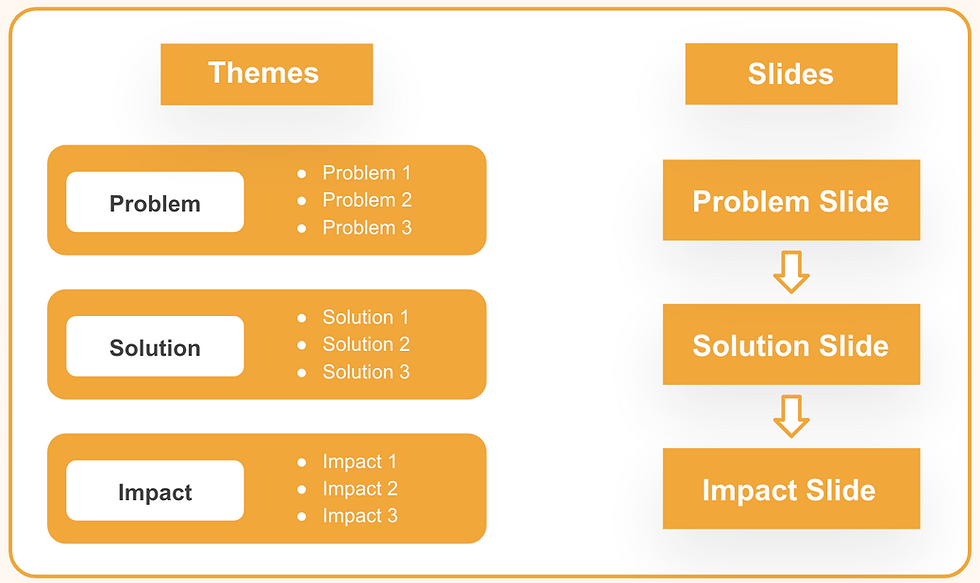

What are Themes? They're the Problems we solve, the Solutions we offer, and the Impacts we generate. These types of messages link together to persuade prospects to buy, with Problems setting up Solutions and Solutions setting up Impacts. P - S - I: That's why we call it P.S.I. Selling.

Most of our sales assets and conversations are built out of these Themes. Our sales deck isn't a jumble of slides, it's broken into sections covering Problems, Solutions, and Impacts. Each section builds on the one that came before.

Our demo isn't a set of clicks on buttons, it's broken into sections each of which covers one major element of our Solution. When we present each element of the Solution, we tie it to relevant Problems and Impacts.

Modularity sets up the next aspect of our guerrilla enablement plan: adaptability.

Built-in Adaptability

Sometimes beautiful is bad, at least when it comes to sales assets.

Imagine that you hire some amazing designers to help you build your sales assets. They'll use design-specific tools and create amazing graphics that intricately express a key point about your product.

Now imagine what happens in the field. A sales rep is getting ready to pitch a prospect and they realize that that beautiful graphic doesn't quite apply to this deal. They don't have access to those design-specific tools, so they just delete the slide and don't use it at all.

Ugh. That's a ton of wasted effort.

A better solution is to design your sales tools to be edited. Use only design tools that the sales team has access to and is proficient with. Make sure the graphics are simple and are built out of elements that reps can move around. And make the text editable so reps can put in facts that apply to the prospect they're selling to.

The same goes for your Themes. They need to be simple, powerful ideas that reps can update as they learn more about the prospect.

The Themes will go through multiple versions over the course of a deal. They start out being your Product Themes, the Themes that are true about your product in general. They become Deal Themes, Themes that apply to the specific deal the rep is selling. Here's an example of how Themes change as the sales rep learns more.

Similarly, assets go from being templates that apply to your customers in general to being edited versions that work for the deal at hand.

Reps are equipped to make these edits efficiently because assets follow regular structures making them easy to adapt while maintaining their persuasive flow.

Rigorous Prioritization

Sometimes enablement seems like an endless task, particularly for small companies. There are a million things you could create that would be useful.

But some assets are ten or a hundred times more useful than others. These are the assets that either set up the whole sales process or that are the foundation for one stage of the sales process.

Start with those. Then work your way to the others if you have time.

The rest of this article is arranged as a set of suggested resources broken out by the stage of the sales process.

But these are the top ten most important resources to create. Click on the item in the list to see more:

These focus on establishing who you sell to, what your main messages are, and how – as a general matter – you communicate and prove those messages.

In other words, this is where you start. If you build great high-priority assets from this section, you’ll have taken a HUGE step forward even if it takes a while to get to everything else.

Ideal Customer Profile (ICP) (High)

This might be the most important resource of all because it defines who you sell to. If your team spends too much time selling to the wrong companies, you’re dead.

It should spell out the types of company you sell to (size and industry) and the types of people you sell to (position and level). Be careful about including too many additional criteria; these can get too conceptual very quickly.

It also needs to rule some companies out. For example, you might specify that reps shouldn’t sell to companies with a specific software platform because you don’t integrate with it.

Make the ICP real by including at least three examples. The first should be a company that’s perfect for your product. The second should be a prospect that’s good but not perfect. The third should be a prospect that looks great… but is actually a huge waste of time.

Explain your reasoning for each of the examples. That will force you to think clearly and help sales reps match their prospects to each of the categories.

Product Themes (High)

These are the general value messages that apply across your entire process. Sales reps should focus almost all of their conversations on the Product Themes.

Product Themes define the Problems you solve, the Solutions you offer, and the Impacts you generate. The Problems lead to the Solutions which lead to the Impacts.

Problem Themes say why the Problem is important and also provide an insight that sets up your product as the best Solution. Solution Themes say how your product resolves a Problem and why it's better than competitors. Impact Themes identify a kind of business Impact and a provide way to estimate its magnitude.

Problem - Solution - Impact; hence P.S.I. Selling.

Try to create three Themes of each type for a total of nine Themes. This lets you cover all the aspects of your product and shift your focus depending on the interests of your audience and the company you're talking to.

Product Themes are meant to be adaptable. Reps will shape them to fit each deal, creating Deal Themes. Check out our videos on Product Themes and Deal Themes for more on Themes.

You should bounce back and forth between the ICP and the Product Themes during your development process. You may need to adjust the Product Themes to match the ICP or adjust the ICP to match the Product Themes. For example, ICP companies need to have the Problems you solve and the Problems you talk about need to be the ones that your ICP companies have.

Summary Slides (High)

Summary Slides ensure that your Themes shape real sales conversations. They are a set of slides that summarize your Problem, Solution, and Impact Themes and appear at the beginning of most sales conversations. Typically, there's one slide for each Theme Type for a total of three slides.

Starting conversations with Summary Slides helps conversations focus on value instead of going off on tangents or becoming a mushy mess.

Demos, for instance, can easily become an unfocused conversation about product details. Starting with Summary Slides recasts the demo as an effort to prove the Solution Themes by showing the product in the context of the Problems it solves and the Impacts it generates.

Summary Slides evolve over the course of the deal as reps have more conversations with the prospect. Check out our video on Summary Slides for more information.

Case Studies (High)

Good case studies are examples of your product providing the value you identify in the Product Themes. They’re not stories about how much the customer liked your tech support.

Case studies should match the Problems in your Product Themes, with at least one case study case study corresponding to each Problem. If a sales rep encounters a prospect with that Problem, they reach for the corresponding case study to prove that you can solve it.

Case studies should almost always be in slide format so they’re easy to present and share. They should also be editable so that sales reps can incorporate the prospect’s terminology (while of course staying true to the core facts).

On the margins, it’s better to make case studies slightly longer and more detailed so that the sales rep can pare them back to focus on exactly what the prospect cares about.

Sales Playbook (Low)

Finally, a low priority resource! The main purpose of the Playbook is to cover material that matters but isn’t important enough to merit a separate resource.

These are often everyday operational matters like: (1) sales stage definitions for your CRM database, (2) who to contact for integration questions, (3) rules of engagement, like how to handle a deal split when one rep develops a lead at a conference that’s in another rep’s territory.

Good playbooks reduce friction and frustration; that said, you can live without one for a while.

This section covers resources that are applicable primarily to specific stages of your sales process. This is a good layout because reps know what stage they’re at and can therefore go to the right section to find what they need.

We'll cover the following stages:

Prospecting is the process of generating leads through outbound outreach, like emails and calls.

Sales can't succeed at prospecting without proper support from the rest of the company. Key enabling factors include strong product-market fit, accurate contact data matched to your ICP, software that lets you send emails at scale, and other marketing channels that complement your prospecting.

Here are a few prospecting ideas to get your sales team started:

Email Templates (Medium)

Emails should be designed to create interest in learning more; not to sell the product.

No single email can or should include everything you want to say. Instead split the content up over a 5 to 9 email sequence.

Most emails should include ~3 of the elements below while staying under 100 words:

1. Trigger: A vivid fact that makes your product relevant. Ideally, this is a recent event at the target company, like their expanding a team that needs your software. This could also be changes in their industry or distinctive traits about their company.

2. Problem: Prospects care much more about their issues than your product. Customize this to their company where you can.

3. Solution: Go light here; we just want to pique some interest.

4. Social Proof: This is critical; examples make your value real.

5. Provocative Insights: These are hard to pull off, but you can build interest if you have a provocative viewpoint that leads to your product.

6. An Ask: Soft asks, like “Interested in learning more?” are in vogue these days.

Call Scripts (Low)

Good call scripts acknowledge the fact that you’ll usually be leaving a voicemail that is designed to drive more engagement with your emails.

Consider the same topics as with email templates, though you’ll probably only be able to use one in a voicemail.

Discovery is the process of learning about a prospect so you can determine if they’re a fit for your product and sell to them effectively if they are.

Discovery is critical to get right: Teams that do bad discovery spend time selling to the wrong prospects or to do a poor job of selling to the right ones. Without proper enablement, most teams will struggle to do good discovery.

Discovery usually happens on the first scheduled call and is often combined with an overview presentation that features a slide deck. The first scheduled call could also be discovery plus a software demo, particularly for less complex products.

Discovery Guide (High)

The discovery guide gives sales reps examples of good questions to ask.

The most important part of discovery is qualification, which helps us know if we should be selling to that company at all. This boils down to the situation (are they the kind of company we sell to), problems (do they have the problems we solve), and authority (am I talking to someone with influence over a purchase decision).

If any of these factors are missing, it's probably not worth selling to that prospect or putting them in a sales forecast. Other factors, like securing budget, are a product of the sales process rather than a condition for starting it.

The next most important part of discovery is developing the prospect’s Problems. We can do a much better job selling to a prospect if their Problems are serious and well matched to our Solution.

For each Problem you solve, craft questions that go several layers deep:

Check out this article for more Problem discovery.

Time permitting, you can also craft example questions about the prospect’s process for making a decision, securing budget, and completing the legal, security, and compliance processes.

Pitch Deck (Medium)

Pitch decks provide an overview of the Themes to facilitate a productive exploratory conversation. This is important if you have a complex product: sharing some high-level information provides something concrete to discuss so you can set the right agenda for subsequent conversations.

That said, if you have a simple product and do a full software demo on your initial calls, you can skip building a pitch deck.

Good pitch decks start with Summary Slides and then have sections covering the Problems, Solutions, and Impacts. Typically, the Solution section is longest. Decks should typically close out with a slide on next steps.

The deck structure might look like this:

That adds up to 16 substantive slides plus divider slides between sections.

If you want a simpler deck, you could omit the section on Problems and maybe also the section on Impacts.

Discovery Call Recordings (Medium)

Recorded calls are sales reps’ favorite way to learn, and for good reason: Recorded calls are real examples from the field, not clever hypotheses from the leadership team.

Aim to have two types of recorded calls: core calls and difficult calls. Core calls are calls with ICP customers that went according to plan. Difficult calls are calls with qualified customers that ask challenging questions that are likely to come up again.

Three recordings of each type of call is enough to start.

Software demos aim to prove that your Solution resolves the prospect’s Problems and generates Impacts by showing the product.

Most demos fall into a trap: They show prospects how to use the product, not what its value is. This doesn’t close deals.

The key is to find ways to ensure that demos stay focused on the Themes.

Demo Guide (Medium)

The Demo Guide is designed to show reps how to focus the demo on Themes by breaking the demo into ~3 sections, each focused on one core element of the Solution. The demo structure is designed to tie each element of the Solution to the Problems it solves and the Impacts it generates. And, of course, the demo begins with a set of Summary Slides.

The structure looks like this:

The demo guide should identify the sections of the demo and give examples of phrases to use for each of the four components of each section: (1) the section orientation, (2) tie to a problem, (3) differentiation from the status quo and competitors, and (4) link to Impact.

For more on well-structured demos, check out this article.

Demo Recordings (High)

Demo recordings are essential. Great sales reps internalize the standard demo flow so well that they can focus all their attention on tying the demo to the Themes and on having a conversation with the prospect.

As with discovery calls, you want a total of six recordings: three core recordings and three difficult recordings.

Product FAQ (High)

Sales reps who can’t answer basic questions about the product burn cycles and create painful misalignments with customers.

The FAQ is an internal document that lists the 20-40 most common product questions and the best answers to them. It should be broken down into sections that correspond to the sections of the demo. This lets reps learn them in the same sequence that they’re likely to be asked.

The FAQ covers the universe of questions that a prospect could reasonably expect a non-technical salesperson to answer – and no more than that. For everything else, it’s fair for reps to loop in a technical expert.

Scoping is the process of refining the shape of the deal while building consensus and maintaining momentum.

Scoping is very important for complex deals; they often spend most of their time in the scoping process and it's easy for deals to wither and die here. Scoping is less important for transactional sales processes where deals move rapidly from demo to proposal to decision.

Here are some ideas for scoping resources:

Multithreading Options (Medium)

Multithreading refers to the process of getting more than one member of the prospect's team involved in the evaluation process.

Multithreading is important. Working with a single point of contact may leave you with insufficient influence to complete a deal, restrict the deal's scope, or make you vulnerable to that person's departure.

Multithreading is also challenging. Your initial point of contact may want to keep control over the conversation and their colleagues may resist getting involved to protect their time.

Don't just tell your team to multithread; give them specific examples of ways to do so.

Persuasion is key: Why is a wider conversation in the interest of your initial point of contact, in the interest of the company, or in the interest of their colleagues?

Here are some examples of arguments you could make:

1. Information: We need to understand the needs of each of your business units to craft a more tailored proposal. We should therefore speak to each team directly.

2. Efficiency: A group conversation will help us efficiently agree on a course of action, therefore we need to present to all the stakeholders.

3. Bargaining: We're excited to set up a free trial of our product, but before we can do that, we need to speak to all of the business units involved so we can configure the trial effectively to ensure it's a good use of their time.

For more on multithreading and managing stakeholders, click here.

Case Study Presentation (Low)

In a case study presentation, your sales team shares how a similar customer used the product and the results they achieved. This helps prove that you can deliver and gives the prospect a sense of exactly how they'll deploy the product.

Needs Workshop (Low)

This involves getting all of the personnel affected by a problem together so that your team can understand their challenges better and propose a more specific solution.

Application Presentation (Medium)

This is a customized presentation or software demonstration that shows how the prospect will use the product.

This can be a multithreading bonanza. You need to gather needs from other members of their team to pull this off. Their executives should attend because the information is critical for their decision. It also puts you in position to ask for a favor because there's a good bit of work involved in creating a presentation like this.

Trial Protocol (Medium)

Trial protocols are important if it takes a lot of work to set one up or if certain conditions need to be in place for the trial to go well.

Trial protocols define the following points:

1. When in the process do you offer trials?

2. What commitments do you need from the prospect to conduct the trial?

3. What tools do you use to make the trial successful?

4. How should the results of the trial be measured? What seems like a good measure but is not and why?

5. How to you present back the results of the trial so the success drives the deal?

Here's an example of a trial protocol that would fit if trials are a big lift for you and for the prospect:

1. Offer trials only after sharing a proposal so prospect can use the trial to evaluate the specific engagement options in the proposal and then make a decision

2. Require that the prospect select a group of motivated participants who agree to spend a certain amount of time evaluating the product

3. Have specified check in points with the trial participants to ensure they stay engaged

4. Measure the results of the trial based on a survey of the participants asking if they think it would be useful in their work. Don't measure the trial based on the number of projects completed because the trial is too short to complete projects.

5. Create a template post-trial presentation that allows the salesperson to share back the results of the trial to make the case for action

Sales teams often get proposals wrong by building proposals that just share a price.

Good proposals communicate value. In fact, they’re often the primary way you communicate value to the executives who will approve the purchase. Those executives seldom join sales calls. They'll probably learn about your product by having an internal conversation where your champion presents the product to them.

The proposal is your champion's template for those internal conversations. It's also designed to be digestible enough that an executive could review it and get the highlights in 5-10 minutes.

Template Proposal (High)

The best proposals do a lot. They:

1. Summarize value: This gives your champion talking points when they present the proposal to their executive team. The best way to do this is usually an updated set of Summary Slides that give an overview of Problems you solve, the Solutions you'll offer, and Impacts you'll deliver. This should be customized based on what you've learned about this prospect.

2. Say what’s different: You’re always competing against the status quo; you may also be competing against other vendors. Why do they not solve the prospect's Problems as effectively as you do?

3. Outline the purchase options and make a recommendation: You may have multiple purchase options with a lot of associated details. If so, take a slide or two to summarize the options and say which you recommend and why.

4. Share pricing: Spell out the details about costs and terms for each of the purchase options. Think ahead to how the prospect might respond and plan your reaction.

5. Provide an incentive for action: One way to do this is before and after pricing. The prospect gets a specified discount for completing the contract before a (reasonable) date. If they complete the contract after that date, the proposal specifies the higher price they'll receive. There should also be a date on which all pricing shared in the proposal expires.

6. Clarify what’s not included: Be sure they aren’t expecting something that you won’t do.

7. Set out the steps to move the deal to completion: This includes finalizing the decision, securing budget, getting a contract signed etc. Prospects are often willing to have a real conversation about planning by the time of the proposal whereas they might not seriously engage on that topic earlier.

8. Discuss the product's functionality: This goes AFTER the other items because it's less important to the decision makers who are the real audience for the proposal. If you lead with this, they'll probably lose interest and stop reading.

9. Share how you'll implement the product: This goes at the end; it only matters to readers who are bought in on your product's value after reading the other sections.

If you have to prioritize, start with 1, 2, 4, and 6.

Proposal Recordings (Medium)

Proposals should be presented on a call, not emailed to the prospect. These are critical calls that managers should often join because they cover so many critical topics: value, pricing, action planning etc.

As with discovery and demo calls, aim to capture at least six calls: three core recordings and three difficult recordings.

Strategy Spreadsheet (Medium)

The strategy spreadsheet does the math on pricing so reps can focus on strategy. It lets reps plug in different parameters (number of licenses, contract term, price per license etc.) to create a menu of options that meet the needs of both sides.

You need a strategy spreadsheet if your product has customized pricing or if deals often involve complex pricing negotiations. Otherwise, you can skip it.

Pricing Policies (Medium)

This defines the rules reps are required to follow, where they need to get approvals, and where they have discretion.

For example, you might:

1. Require that purchases be above a certain number of licenses to recoup your fixed costs

2. State that reps should charge specific one-time fee for an integration, unless your CFO approves waiving the fee

3. Provide that reps have discretion to price a purchase of 1,000 licenses anywhere within a given range

Mutual Action Plan (MAP) (Low)

These are a shared plan that reps make with the prospect spelling out the steps each side will take to complete the evaluation and close the deal.

These are worthwhile: Good project management is key to getting deals done.

But many companies overestimate their significance. Partly that’s because action planning should be part of the proposal, meaning that this box is already partly checked.

But it’s also because MAPs are a comfortable way to explain sales problems that can obscure the real issues.

A CEO might tell herself: “All the fundamentals are OK, it’s just that we need to be more organized about the execution process. Requiring MAPs on all deals will fix everything!”

Maybe.

There’s usually a deeper problem if loads of deals are getting stuck. That’s why I give MAPs a low priority level.

Now for the fun stuff!

Contract Templates (High)

Don’t let there be any mystery about where to find your latest order form and non-disclosure agreement (NDA) templates.

Legal FAQ (Low)

External legal FAQs can be a good idea. These explain what your product does and clarify any misconceptions that can lead to unnecessary redlines. Your sales team would share the external legal FAQ with the prospect at the same time they share a contract.

Here's an example of a misconception you'd want to address: In the old days of SaaS, the buyer's lawyers often thought they were purchasing software as a product they owned rather than as a recurring subscription to software the provider owns. That misconception could lead to a lot of unnecessary edits to the contract.

It's more debatable whether you should create an internal legal FAQ. These give sales reps answers to the contract questions that prospects most commonly ask so they can talk through them on calls. They are not shared with the prospect.

You need to create an internal legal FAQ if you want sales reps having conversations about contract terms. They lower the potential risks of those conversations and define the boundaries of what sales reps should be talking about themselves versus calling in an expert.

But do you really want sales reps having conversations about contract terms? It’s usually more efficient to have the lawyers talk directly or to have the prospect share written redlines.

Security FAQ (Low)

External security FAQs can be a good idea. These make your case that (1) your product doesn't require the highest level of security scrutiny (if you can fairly make that argument) and (2) that your product has excellent security. Your sales team would typically share this along with your contract - perhaps after securing an NDA.

These can help avoid unnecessary security reviews and contract edits.

Some teams create an internal security FAQ that gives reps answers to security questions so they can talk through them on calls. Query whether you want sales reps answering these questions or whether the experts should talk directly.

Proper handoffs between the sales team and the post-sale teams are critical. Bad handoffs lead to lower renewal rates and missed upsells because critical knowledge doesn't transfer.

Few companies do handoffs well. Post-sale teams often often create lengthy handoff documents for sales to complete. Sales frequently finds these to be excessive and ignores them.

At a minimum, sales should document the following points in the CRM: the business problem you’re solving for the prospect, the main point of contact for the deal, and how they got funding for the original purchase.

Post-Sale Handoff Document (High)

If you sell substantial deals (over $30,000) consider having a formal handoff document. This template covers the bases and it's short. If anyone wants to add anything to it, they have to have a very good reason.

In a perfect world, all of this information would live in the CRM. In practice, it's surprisingly hard to include much of this information in the CRM in a usable form. But you can definitely shorten the template below to the extent that information is in the CRM.

There are four parts to the post-sale handoff doc:

1. Value

First, define what customer is trying to achieve with this purchase:

(a) What Problems are they trying to solve?

(b) What parts of our Solution are they focused on?

(c) What Impact are they trying to create?

This should sound familiar! Sales can complete this section by copying in the latest set of Summary Slides and adding a few details for context and clarity.

Second (if relevant), highlight any needs that the customer has that weren't addressed by this purchase. Those unaddressed needs become the focus of upsell efforts.

2. Purchase and Potential Challenges

What did they buy and what do we need to look out for?

The basic details of the purchase (quantity, term, options) should be in the CRM.

Sales also needs to document anything that’s not obvious about the purchase, like requirements that are buried in the contract terms or technical hurdles that the post-sale team needs to address.

You should also include the final, accepted proposal because it encapsulates what they bought, why they bought it, and what expectations were set at the time of the purchase.

As a bonus, you can include information about any engagement options they considered but rejected. Prospects may seek to revive these rejected options as part of expansion or renewal conversations.

3. Milestones

What key dates do we need to be aware of?

Here are three examples:

(a) Required launch dates: Document what needs to be live when.

(b) Upsell triggers: Did sales informally agree to have a chat about expanding the deal after six months if things were going well? Write that down!

(c) Budget/decision process: Some companies authorize budgets at specific times or according to a specific process. The post-sale team needs to know if annual budgets are set in October so they don't miss their window to get a renewal or upsell.

4. People

At least three kinds of people need to be identified:

(a) The Champion(s): Who were the most involved business stakeholders who drove the discussion forward? What do they want out of the project?

(b) The Team: Who are we going to work with to get the software implemented and keep it running smoothly? What challenges (if any) should we know about in working with them?

(c) The Funder(s): Who made the final decision to allocate budget? What do they want out of the project?

Ideally, this information lives in the CRM. But if your CRM just includes a long list of names attached to the account with no context, you need to put this in the doc.

These keep the team running smoothly.

Manager on Calls Tracker (Medium)

This tracks how many live calls the manager has been on with each sales rep. It’s designed to keep the manager in contact with the field and in contact with each rep.

It should include a minimum target of one call per rep every two weeks, or six calls per quarter with each sales rep. More is better but that’s the minimum.

Without that target, managers will spend the vast majority of time with their best reps. The best reps seek manager involvement because they want to win and have complex deals that benefit from a second pair of eyes.

It’s OK for managers to spend a lot of time with high performers; it’s inspiring how the best reps can often do even better.

But you can’t let underperforming reps hide. The target is set low so that there’s clearly a problem if it’s not being met.

Forecasting Spreadsheet (Low)

If you don’t have forecasting software, you need a spreadsheet where everyone can enter their forecasts.

Your team is very likely to fail if they’re not properly enabled. That’s the bad news.

The good news is that there’s a way to enable them even without a lot of resources.

Prioritize ruthlessly. Think clearly. Make progress in little bits as you have time.

That’s guerrilla sales enablement.

- - -

If you liked this article, have a look at our piece on discovery skills so you can make your team proficient at the sales skill that sets the entire process up for success. You can also check out the P.S.I. Selling Content Page for more insights on sales communication, strategy, and leadership.

Want to build a sales process that proves value and a team that can execute? Get in touch.

For more about the author, check out Mike's bio.

Want to send someone a link to a specific part of this article? The index below is composed of clickable links that will take you to that individual section: